-

Industry

-

Solutions

- Thinking

- People

-

Locations

-

Dedicated and expert resources with local experience and established networks. Explore our locations and connect with us.

-

-

About

-

MinterEllison is about creating sustainable value with our clients, our people and our communities

-

- Careers

eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJuYW1laWQiOiI3YTBkMTc5OC0yOWRlLTRiMGYtYWFjNS03MjBlYWU2MTg0ZmYiLCJyb2xlIjoiQXBpVXNlciIsIm5iZiI6MTc2NjQ0NDE4NCwiZXhwIjoxNzY2NDQ1Mzg0LCJpYXQiOjE3NjY0NDQxODQsImlzcyI6Imh0dHBzOi8vd3d3Lm1pbnRlcmVsbGlzb24uY29tL2luZnJhc3RydWN0dXJlLyIsImF1ZCI6Imh0dHBzOi8vd3d3Lm1pbnRlcmVsbGlzb24uY29tL2luZnJhc3RydWN0dXJlLyJ9.BeN7iQW8UI9DfY_DZg4GE3c5NYdP9REAOTwSkxZzu4M

https://www.minterellison.com/infrastructure/

CLOSE

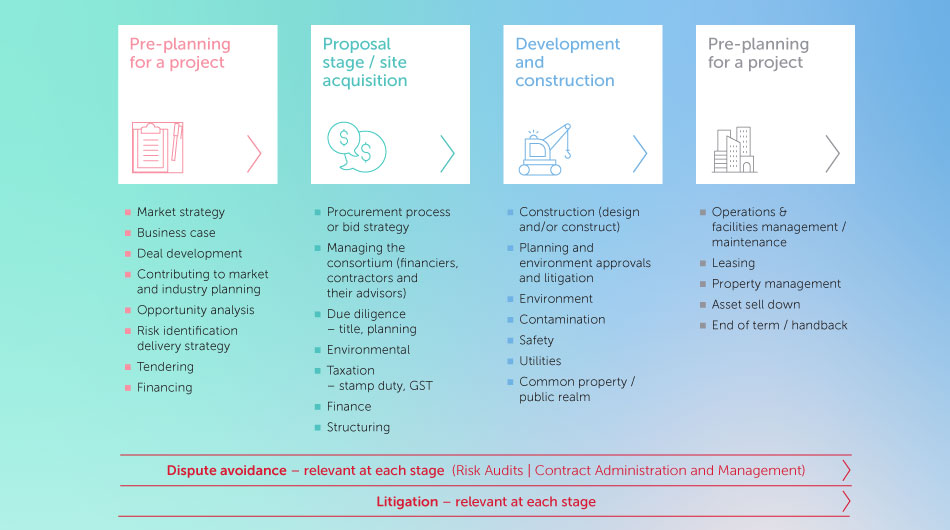

Unprecedented demand for social infrastructure in Australia presents considerable challenges and opportunities for governments and the private sector alike, with both seeking innovative ways to deliver the essential health, education, housing and justice needs for our growing communities.