What is a scheme of arrangement

Schemes of arrangement are becoming increasingly more popular in recent years as the preferred way in which 'takeovers' of Australian listed companies are effected.

A scheme of arrangement is a procedure under Part 5.1 of the Corporations Act that allows a company to reconstruct its capital, assets or liabilities with the approval of its shareholders and the Court.

A scheme can be used to effect a wide range of corporate restructures. The most common use of the scheme procedure is to effect the same outcome as a takeover bid by transferring all shares in the target to the bidder in return for consideration paid by the bidder to the target shareholders.

Overview of a scheme of arrangement

Under a scheme of arrangement, the bidder and target must first reach agreement to propose the scheme to target shareholders, following which approvals are sought from both target shareholders and the Court.

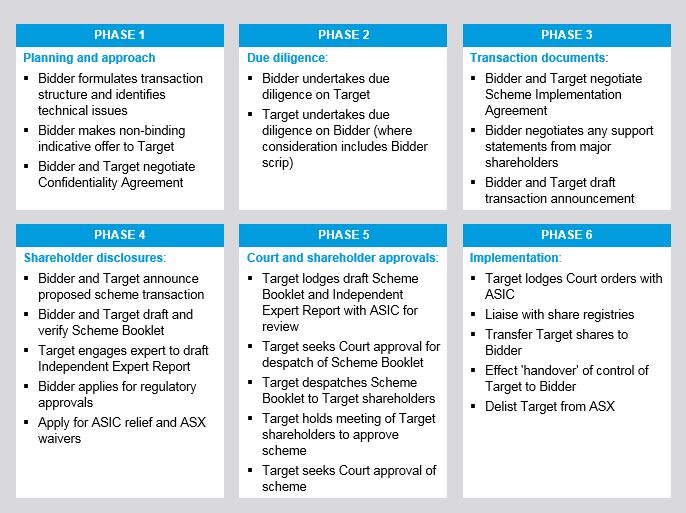

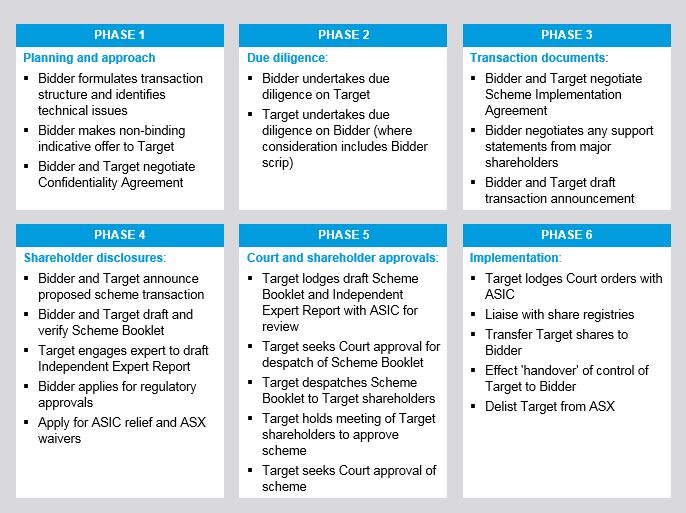

The key phases and steps in a scheme of arrangement are shown below:

Key steps in a scheme of arrangement

Initial Approach

The first step in the scheme process will typically involve the bidder approaching the target with an indicative offer to propose a scheme under which bidder would acquire 100% of target.

Due Diligence

If the target is amendable to the bidder's offer, the target will typically grant the bidder a period of due diligence (either on an exclusive or non-exclusive basis) so that the bidder can confirm its interest in the target and the amount of consideration to be offered by the bidder.

If the proposed consideration includes bidder scrip, the target may undertake some due diligence on the bidder to confirm the value of the bidder scrip.

Scheme implementation agreement

Before the scheme proposal is publicly announced, the bidder and the target will typically enter into a 'scheme implementation agreement' which:

- sets out the terms of the scheme and commits the bidder and the target to the scheme transaction;

- obliges the target to propose the scheme to target shareholders, and to ensure that the target directors recommend that target shareholders vote in favour of the scheme in the absence of a superior proposal; and

- sets out how the bidder and target will work together throughout the approval process.

The scheme implementation agreement will typically contain 'deal protection mechanisms' such as:

- 'no shop', 'no talk' and 'no due diligence' obligations on the target to seek to prevent the target from proactively generating rival bidders;

- a notification and matching right for the bidder to be notified of and have the opportunity to match any third party offer for control of target before target directors may recommend that third party offer to target shareholders; and

- a break fee (generally not exceeding 1% of the equity value of the target) payable by target to bidder if a third party is successful in obtaining control of target or if the target directors change their recommendation to vote in favour of the scheme in certain circumstances.

The scheme is typically publicly announced for the first time when the scheme implementation agreement is executed. That announcement commonly attaches a full copy of the scheme implementation agreement.

Shareholder disclosure and approval process

After the scheme is publicly announced, in order to seek shareholder approval, the target (with the assistance of the bidder) prepares a disclosure document known as a 'scheme booklet'.

The scheme booklet generally contains all information known to the target and the bidder that is material to a target shareholder's decision as to how to vote on the proposed scheme.

The scheme booklet will include an independent expert report valuing the target shares and opining on whether the scheme is in the 'best interests' of target shareholders.

The target lodges a draft of the scheme booklet with ASIC for review, which will take at least 14 days.

Following ASIC's review, the target seeks the Court's approval at the 'first court hearing' to mail the scheme booklet to all target shareholders and to convene a meeting of target shareholders to vote on the scheme.

The target will then hold the shareholder vote on whether to approve the scheme at the 'scheme meeting'.

For the scheme to be approved, a resolution in favour must be passed at the scheme meeting by each class of target shareholders by both:

- 75% of the votes cast on the resolution; and

- more than 50% in number of the target shareholders voting on the resolution (in person or by proxy).

Court approval and implementation

If target shareholders approve the scheme, the target will then seek Court orders approving the scheme at the 'second court hearing'.

The Court may not approve the scheme unless ASIC has given the Court a statement that ASIC does not object to the scheme. In advance of the second court hearing the target will seek confirmation from ASIC that the statement will be provided to the Court.

If the Court approves the scheme at the second court hearing, it will become binding on the target company and all of its shareholders when the Court's orders are lodged with ASIC (usually by the next business day), including on those target shareholders who voted against the scheme or did not vote at all at the scheme meeting.

Following that final Court approval of the scheme, the scheme is implemented by the transfer of all target shares to the bidder (pursuant to one master share transfer form) in return for payment of the scheme consideration.

Delisting of target from ASX will usually take place soon after implementation of the scheme.

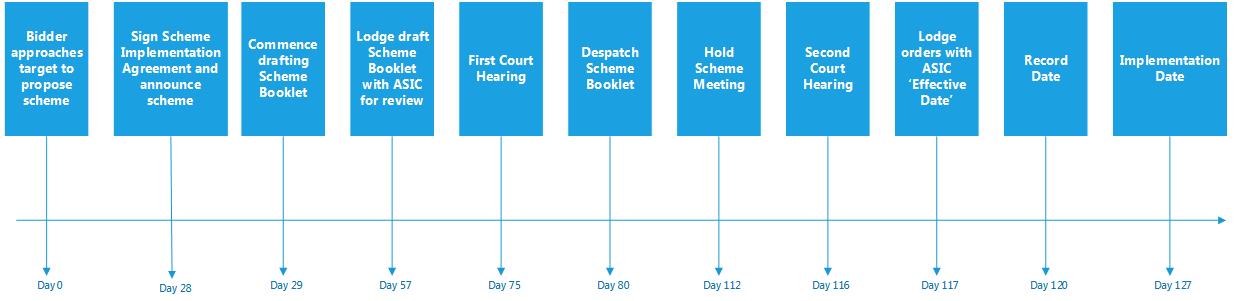

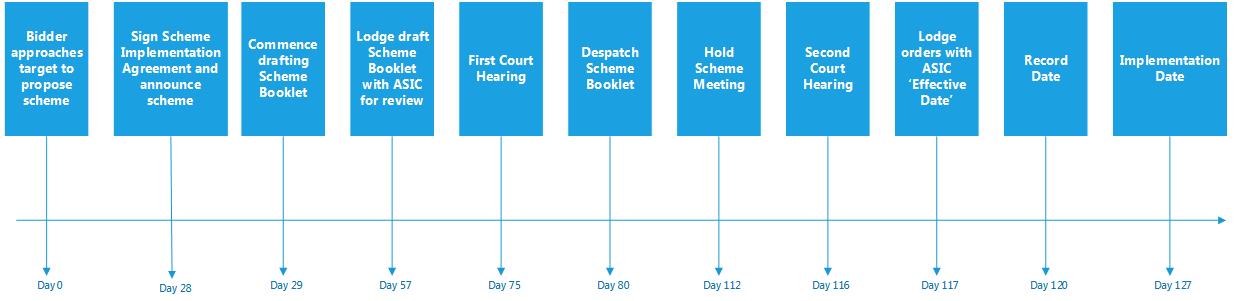

Indicative timetable for a scheme of arrangement

The overall timetable for a scheme of arrangement is not prescribed by law, but legal requirements include:

- a minimum 14 day period for ASIC to review the draft scheme booklet;

- at least 28 days' notice to target shareholders before the scheme meeting can be held;

- sufficient time to provide the Court with relevant documentation to hold two Court hearings in accordance with Court rules; and

- prescriptive timings under the ASX Listing Rules for steps between the scheme becoming effective and being implemented, including the record date for determining who participates in the scheme as a target shareholder.

As a result, a scheme typically takes about four months to implement from the date of the bidder's first approach to target, but can be up to six months or longer if significant due diligence is conducted before the scheme is announced or substantial regulatory approvals are required such as FIRB and ACCC.

It is important to factor into the timetable for a scheme that the Courts are generally closed from mid December until early February, which may materially delay the first or second court hearings.