The Australian Taxation (ATO) has today issued a draft 'Practical Compliance Guideline' which sets out how it intends to deal with cross-border related party financing arrangements from 1 July 2017.

The recent Full Federal Court decision in Chevron would appear to be the catalyst for this extraordinary document, which takes the debate on how the ATO will approach intra-group debt arrangements to an entire new level.

Significantly, the Guideline signals an intent to litigate those cases which fall within the 'Red Zone' rather than settle through alternative dispute resolution processes.

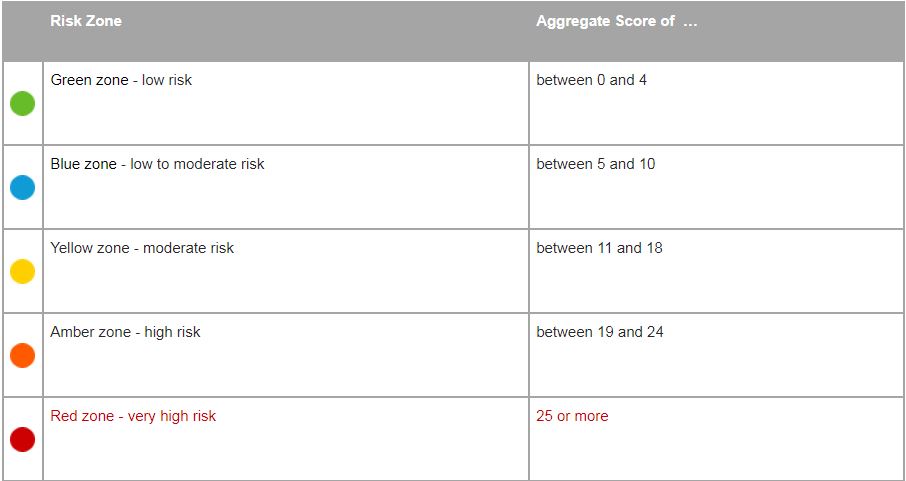

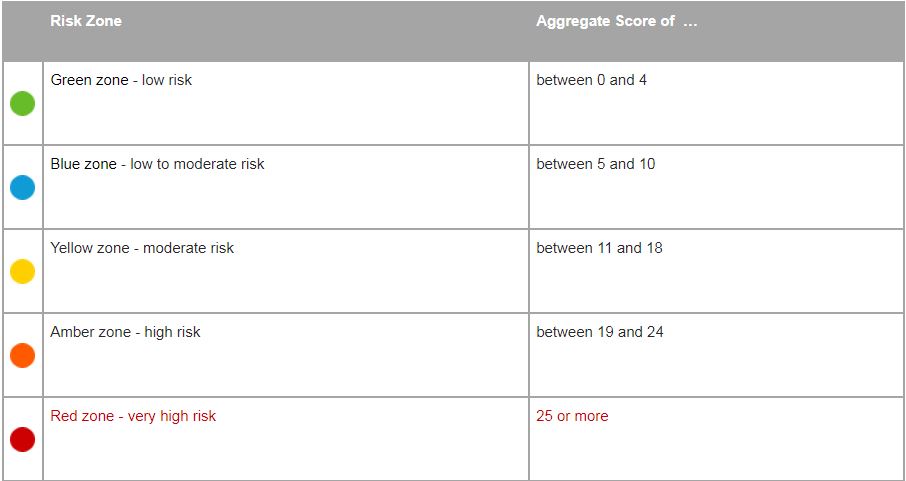

Related party financing risk indicator guide

The Guideline includes a 'Related party financing risk indicator guide' which asks a series of questions about each intra-group financing arrangement and assigns a number to each answer. The relevance of these numbers is set out in paragraph 86 as follows:

86. Your aggregate score for all relevant indicators will determine your risk zone for your financing arrangement, that is:

Transitional arrangements

The Commissioner will give taxpayers 18 months to make voluntary disclosures which adjust pricing levels for back years so that they fall within the green zone. Provided full and true disclosure is made in that time, the Commissioner will remit penalties and shortfall interest in full.

Comparable arrangements

The Commissioner will look carefully at potentially comparable transactions rejected by taxpayer’s in their transfer pricing documentation. This potentially means the report you have paid a lot of money to protect you may be used against you by the Commissioner.

Global treasury policy

The Commissioner considers interest rates on any intra-group borrowing which exceeds the group’s global cost of debt by more than 100 basis points to be high risk and likely to lead to a dispute, even if the other factors set out in the table are low risk.

This is significant as it elevates the debate on 'implicit support' by the ultimate parent company to a new level, and is likely to result in significant controversy with multinational groups operating in Australia.

In Chevron, evidence of the global treasury policy documents led the Court to find Chevron’s policy was to borrow externally at the lowest cost. This finding was significant as it informed the Court what would have happened if the actual loan had been with an external lender.

The Guideline also highlight the risks associated with financing arrangements which fall outside of a 'vanilla' loan, for example the use of promissory notes and other financial derivatives. If you have such an arrangement, expect to be talking to the ATO very soon.

Another significant, and controversial aspect of the Guideline concerns the currency of the borrowing.

The ATO take the view that the currency of any borrowing should be the same currency as the 'operating currency', which is defined to mean the currency in which the borrower earns the majority of its revenues.

This was one of the issues in the Chevron litigation, and the Federal Court has been somewhat equivocal as to whether the position now taken by the Commissioner is correct. The Commissioner’s argument was rejected at first instance, and the Full Federal Court said they did not need to answer the question.

This is particularly relevant to the resources sector who generally earn revenue in USD.

Action steps

If your organisation has an intra-group cross border loan, you need to re-assess your loan arrangements with a critical eye, including making sure you have all the necessary evidence you need to defend your position.

This is not just an academic question, the Guideline states you may have to answer questions in your next tax return as to the rating you have arrived at after applying the Guideline to your financing arrangement.

MinterEllison were instructing solicitors for the Commissioner in the Chevron litigation. Our clients have said that this puts us in a unique position to assist them meet the challenges looming in the near future from the Commissioner’s focus on cross border financing arrangements. We are here to help.

Practical Compliance Guideline PCG 2017/D4